CEE currencies tread water as the holiday season ends

- întoarce-te

- Latest

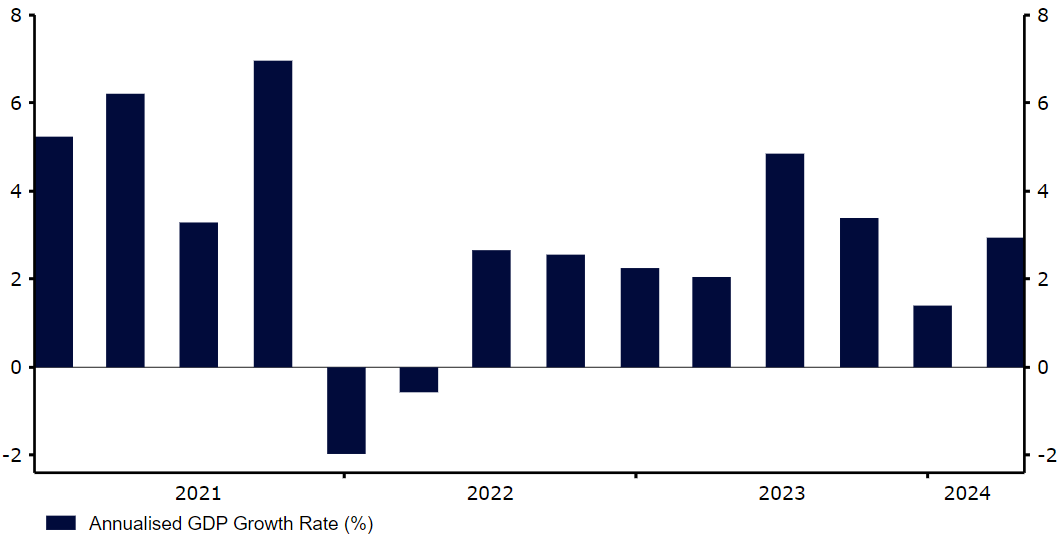

Signs continue to emerge that fears of a US recession are exaggerated, in the form of solid high frequency data like weekly jobless claims.

Now that US inflation seems to have returned convincingly to the 2% target, market focus is likely to shift back to labour market data. This week is shaping up to be a critical one on that front, with the JOLTS job openings report on tap for Wednesday, followed by weekly jobless claims on Thursday and the all important US payrolls report for August on Friday. The latter will probably determine the size of the Fed interest rate cut expected later in the month. Specifically, a significant increase in the unemployment rate (not the market’s base expectations) will probably cement the case for a 50bp cut and bring about further dollar weakness.

USD

For all the fretting about a US slowdown, most economic indicators continue to be consistent with steady growth and a solid performance of the labour market, cementing our stance that a recession is not in the offing anytime soon. We are paying particularly close attention to the weekly jobless claims indicator, and it continues to bounce around near all time lows relative to the size of the US labour force. Second-quarter GDP growth was revised higher last week on stronger consumer spending, though this is admittedly a lagging data point.

Figure 1: US Annualised GDP Growth Rate (2021 – 2024)

Source: LSEG Datastream Date: 02/09/2024

The key test comes this Friday as the August labour report is due to come out. Markets are pricing in about a one-third chance of a 50bp cut from the Fed at its September meeting (18/09), but we think this is too much and expect that a solid NFP print will confirm our view. Another sizable downside surprise, however, could raise expectations for a bumper cut, and would almost certainly trigger fresh downside in the US currency.

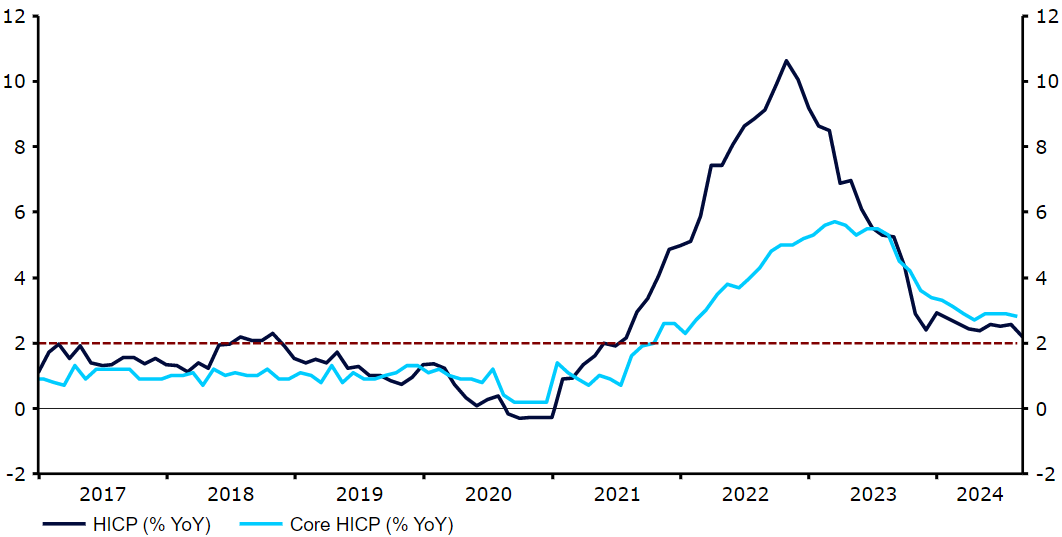

EUR

Rounding effects meant that the August Eurozone flash inflation report came in right in line with economists’ expectations, but the details were less flattering. Inflation in the services sector, which is usually stickier, accelerated slightly to 4.2%. Sticky inflation, continued good news on unemployment, which fell to another Eurozone historical low of 6.4%, probably means that the ECB will be happy to stick to a schedule of one cut at every other meeting. Markets are pricing in a considerably more dovish outcome, which means there is potential for further euro upside as these expectations are disappointed.

This week will be largely centered around Friday’s US payrolls report, although economic news out of the common bloc in the interim could shift EUR/USD. We will be paying close attention to revised PMI and GDP figures on Wednesday and Friday respectively, and the July retail sales report (Thursday).

Figure 2: Euro Area Inflation Rate (2021 – 2024)

Source: LSEG Datastream Date: 02/09/2024

GBP

The British pound continues to put in solid performances and remains the top G10 currency so far in 2024. Resilient domestic demand, an economy that is performing better than expected and hopes for an improvement in relations with the European Union under a Labour government, along with Sterling’s undeniably attractive valuation, continue to buoy the British currency.

There is little news of note out of the UK this week, but we expect that relatively high UK rates still mean that the path of least resistance for the pound is up. The Bank of England is clearly in easing mode, although the resilience of the UK economy suggests that the pace of MPC rate cuts will be a gradual one. Markets are assigning no more than a 1-in-4 chance of another cut from the BoE in September, though this may change should upcoming data on the labour market, GDP and inflation surprise expectations.

RON

It was a relatively dull period for Romania macro-wise with no tier-1 macro releases out last week. This one started off with a publication of August manufacturing PMI (48.4), which proved that the demand, particularly external, remains poor. Not much is on the tap throughout the remainder of the week apart from retail sales numbers set to be released on Thursday and the GDP revision (0.1% QoQ in Q2) out on Friday.

PLN

The zloty’s recent performance has been unimpressive, but the sideway trend of the EUR/PLN continues. The latest data has confirmed that inflation in Poland is developing as expected. The headline measure printed at 4.3% in August, up marginally from the previous month. The current economic landscape in Poland and near-term expectations of its development make it clear that no rate cuts are set to happen in the coming months. The question is whether these will take place in 2025 – and if so, when exactly.

A tentative pick-up in growth, led by consumption, is probably not enough to impact the timing significantly (and recent data covering early Q3 has been rather disappointing), but the latest Fed turnaround increases the likelihood of a cut in H1 2025. The signals are not strong, but decisionmakers in Poland seem to be looking towards rate cuts with a kinder eye. At the same time, fiscal policy characterised by gargantuan deficits adds to inflation uncertainty and may encourage patience. Perhaps this week’s NBP meeting will provide more hints, although it’s likely too soon to expect precise guidance.

HUF

Forint topped the chart last week, strengthening against the euro. We attribute the appreciation primarily to the MNB’s first pause in cutting rates in nearly a year, which vividly emphasised risks to the inflation outlook in its statement. Geopolitical tensions, a global economic slowdown, and international uncertainties were also brought into focus, albeit a secondary concern, in our view.

Figure 3: Hungary CPI Inflation & Wage Growth [YoY] (2020 – 2024)

Source: Bloomberg Date: 02/09/2024

Meanwhile, wage growth, which could prove key for the aforementioned inflation outlook, eased to a 16-month low yet still placed at a sky-high 13.3%.

This week’s calendar will concentrate on ‘hard’ macro readings, particularly retail sales (Thursday) and industrial production (Friday). The latter is set to print at rather poor levels as forward-looking data suggests – today’s HALPIM manufacturing PMI reached an 11-month low. Tuesday’s GDP revision might grasp interest, too.