CEE currencies take another hit

- întoarce-te

- Latest

CEE currencies suffered large losses last week as risk-off, rates repricing and subsequent dollar rally prevented them from catching a breather.

Figure 1: CEE FX Performance Tracker [base: EUR] (27/09 – 04/10)

Source: Bloomberg Date: 07/10/2024

USD

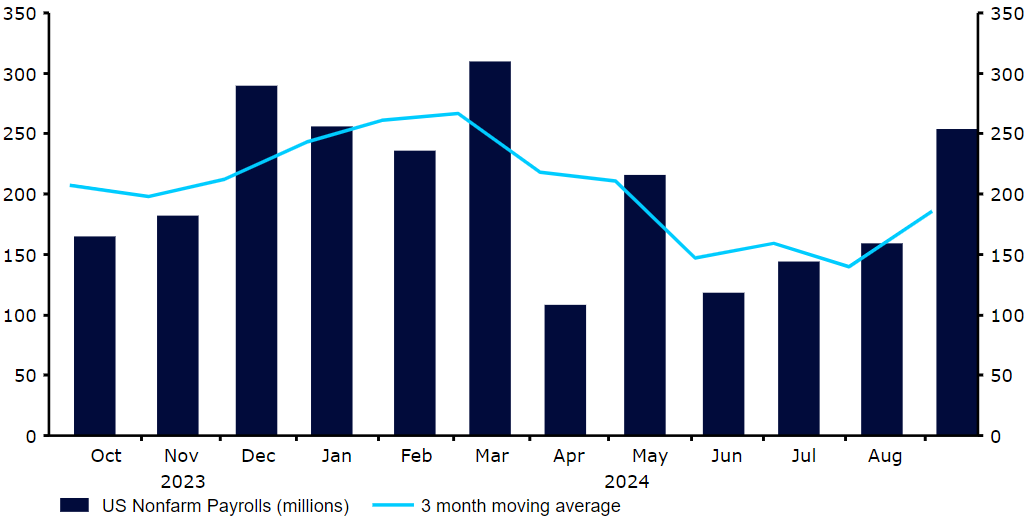

The September payrolls report in the US came out much stronger than expected, as job creation, unemployment and wage increases all came out significantly better than expected. The Federal Reserve appears to have engineered a proper soft landing, which should increase the chances of a more gradual pace of FOMC policy loosening – chair Powell nodded to as much during his remarks last week. Indeed, markets now see less than a 10% chance of a 50bp cut from the Fed next month, with a ‘standard’ 25bp cut now the market’s clear baseline scenario.

Figure 2: US Nonfarm Payrolls (2023 – 2024)

Source: LSEG Datastream Date: 07/10/2024

Risk assets cheered the prospect of lower rates, while the US economy is still going strong, and the dollar further benefited from geopolitical fears about the Middle East escalation. The main source of uncertainty now is the presidential election in November. This remains too close to call, with betting odds now pointing to an effective dead heat following last week’s VP debate.

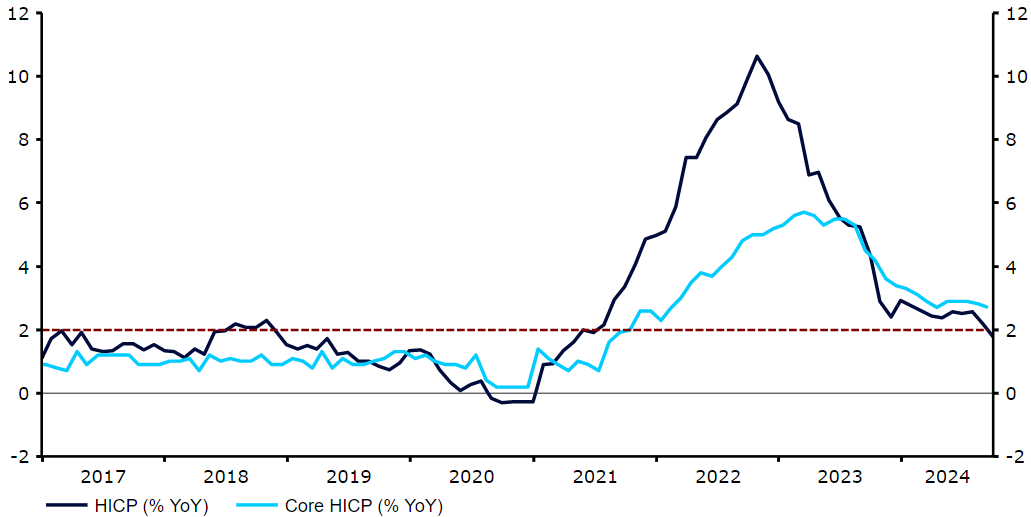

EUR

Another mild inflation report out of the Eurozone last week means that the ECB is on course to ease policy again at its October meeting. In fact, rate markets are pricing in cuts at each of the next four meetings, all the way into the second quarter of 2025. While we think that this is a bit aggressive, clearly the deterioration in activity data risks a more rapid pace of cuts. Encouragingly, last week’s September PMI figures were revised upwards from the initial estimate, although the data remains consistent with stagnation in the bloc’s economy.

The sharp divergence in economic performance with the US means that the interest rate differential has seen the sharpest widening since the pandemic, and the euro has suffered as a consequence. A slew of economic data from August this week, as well as a number of ECB speakers and the minutes for the central bank’s last meeting will be on tap this week.

Figure 3: Euro Area Inflation Rate (2017 – 2024)

Source: LSEG Datastream Date: 07/10/2024

GBP

Sterling’s relentless rally, which in trade-weighted terms is now more than two years old, took a breather last week. Traders used some dovish comments by Governor Bailey as an excuse to realise some profits. Bailey warned that the MPC could cut rates more aggressively should UK inflation continue to ease, although chief economist Pill seemed to pour cold water over these remarks only a day later. Markets responded by pricing in a more aggressive BoE easing cycle, but we think that Bailey’s comments were taken too literally, and were merely intended as a warning, rather than a confirmation of a faster pace of cuts ahead.

Despite last week’s retracement, the pound remains the best performing G10 currency of 2024. This week’s August GDP release on Friday should confirm the relative resilience of UK demand, at least compared to the Eurozone, so we look for the sterling rally to pick up again, at least in the absence of any dramatic developments from the Middle East.

RON

In line with our expectations, the NBR decided to pause after two consecutive interest rate cuts last week. Furthermore, looking at the signals coming from the bank, particularly the emphasis on the negative impact of deficit reduction efforts on the inflation outlook, it seems likely to us that rates will be kept unchanged at least until the end of the year. Another noteworthy aspect of the meeting is the extension of Muguru Isarescu’s term of office for another five years. He is the longest-serving central bank governor in the world, having taken his position in 1990.

The latest news from the inflation front will arrive on Friday. The headline measure is expected to slow down further but is still set to remain at a high level, just below 5%. On the same day, we will receive data on wage growth, likely to place close to double digits in real terms once again. Favourable labour market conditions seem to be translating into firmer household demand – last week saw retail sales rise to 9.2% in August.

PLN

Last week was difficult for most emerging market currencies, and the zloty was no exception. The high-beta currency actually underperformed most EM currencies, with the aforementioned HUF and KRW being the only exceptions. External factors are largely to blame, namely the risk-off caused by concerns over the Middle East and a sharp rates repricing in the US that accelerated after the NFP report. Concerns about the health of the Eurozone economy also persist, casting a shadow over the region. Undoubtedly, an almost 1% weekly depreciation vs the euro is sizable, but to put things in perspective the EUR/PLN is now only slightly above the 4.30 mark.

Locally, attention was paid to the NBP meeting. Needless to say, rates were unchanged with the focus on governor Glapiński’s press conference. Despite an increase in inflation to 4.9% in September, his tone shifted further in the dovish direction, and both his comments, as well as the recent evolution of risks, suggest the scales might be tipping towards a cut in March. That said, there is still a long time to go before rate decreases become realistic, and we are in a particularly uncertain period right now.

HUF

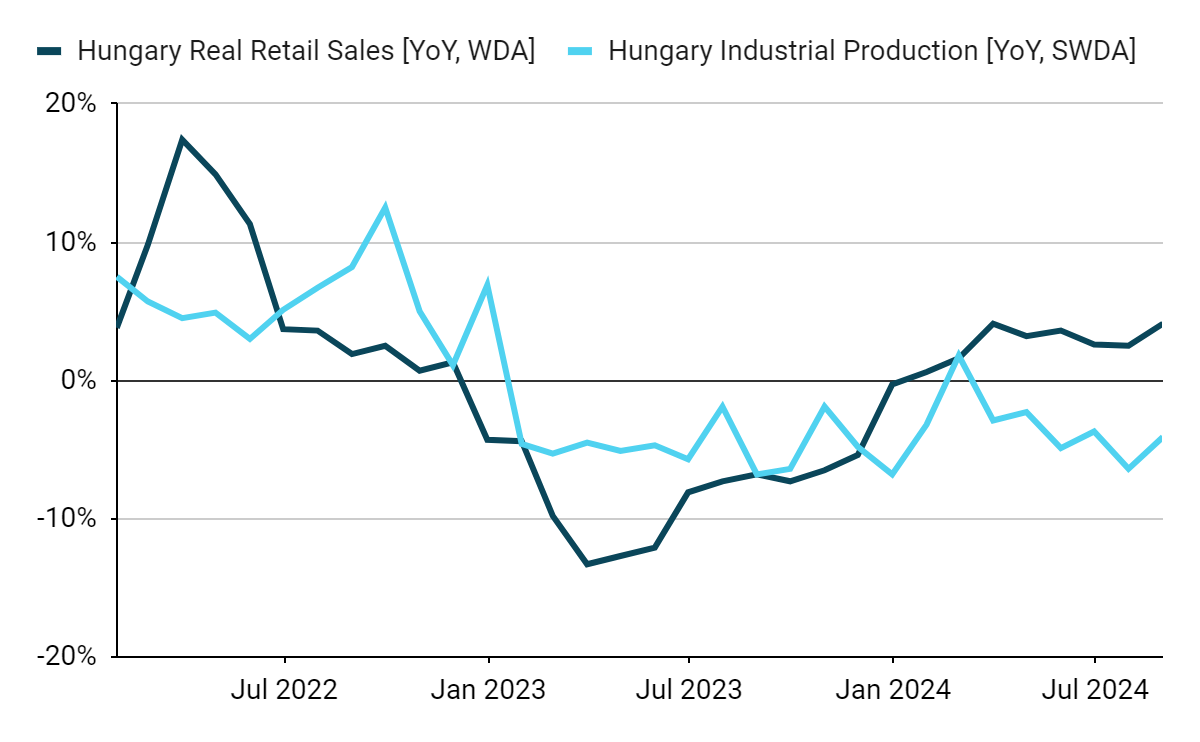

A decent retail sales reading from today (4.1% YoY, the highest since May 2022) was accompanied by a less-than-stellar industrial production figure (also 4.1%, but in the negative), revealing a picture of a still fairly subdued Hungarian economy, grasping hope in the revival of domestic demand. For the forint, as for other currencies in the region, however, the most important factors last week were external – news from the Middle East and the US. Not only did the Hungarian currency reach its lowest level against the euro since 2022 (EUR/HUF at 401), it performed the worst of all emerging markets (ex aequo with the KRW). This clearly shows how vulnerable the forint is to changes in sentiment.

Figure 4: Hungary Real Retail Sales & Industrial Production [YoY] (2022 – 2024)

Source: Bloomberg Date: 07/10/2024

Thursday will bring the September inflation reading. We expect it to decline further, which could cement our expectations of a more dovish MNB policy in the coming meetings.