US election comes down to the wire

- întoarce-te

- Latest

Markets are bracing for the biggest event risk of the year this week, with Tuesday’s US presidential election to potentially be one of the closest races in recent history.

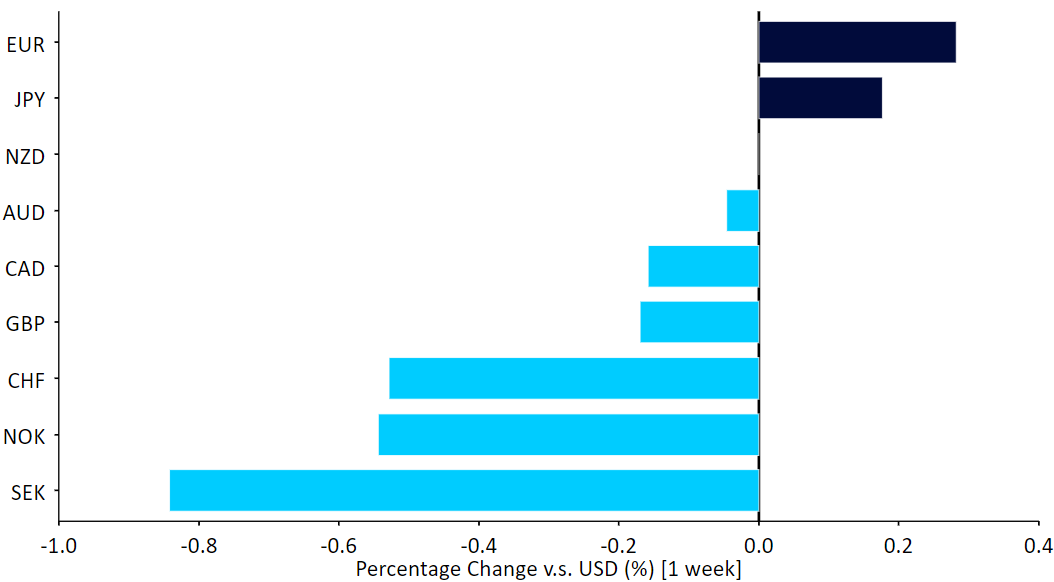

The slight swing in the polls back towards Harris was negative for the dollar last week, as was the latest macroeconomic news, which showed weakness in the US labour market and strong GDP and inflation data in the Euro Area. However, the moves were modest, as the unpredictability of Tuesday’s event looms over markets.

Even Thursday’s Fed meeting, where a 25bp cut is eyed, has been pushed into the background. The Bank of England also meets on Thursday under similar expectations as the Fed, and the standing committee of the national people’s congress meets in China, raising the possibility of additional stimulus there.

Figure 1: G10 FX Performance Tracker [vs. USD] (1 week)

Source: LSEG Datastream Date: 04/11/2024

USD

The apparent increase in support for Kamala Harris in the polls in the past few days has not necessarily been reflected in a broadly weaker dollar, perhaps attesting to the fact that markets were barely pricing in a Trump victory, and that the ‘Trump trade’ provided little more than modest support for the greenback. This suggest room for a sizable dollar rally in the event of a Trump win on Wednesday morning, particularly under a Republican controlled Congress, while we think that a Harris victory would be bearish. See here for our full preview report ahead of Tuesday’s vote.

Last Friday’s weak labour market report contradicted strong third-quarter GDP data in the US, but this was blamed primarily on hurricane distortions. Wage and inflation data continue to show resilience, and were it not for the US elections would probably warrant attention from the Federal Reserve when it meets on Thursday. While the Fed will almost certainly validate market expectations and cut by 25bps, market attention will focus on guidance for the next and last meeting of 2024, where expectations for a pause, while low, are starting to rise.

Figure 2: US Nonfarm Payrolls (2023 – 2024)

Source: LSEG Datastream Date: 04/11/2024

EUR

We finally received some good, albeit lagged, economic news out of the Eurozone last week, as the third-quarter GDP report suggested that fears surrounding stagnation, and even an outright contraction in activity, were perhaps slightly overdone. According to the report, the Euro Area economy expanded by 0.4% in the three months to September, double the estimate of economists.

The Euro received a further boost from the stronger-than-expected October flash inflation reading. Expectations for a 50bp cut at either of the next two meetings continued to be pared back as a result, though the euro, like all other currencies, is reacting most strongly to US electoral newsflow and will continue to do so this week, in which European economic or policy news will be very thin.

GBP

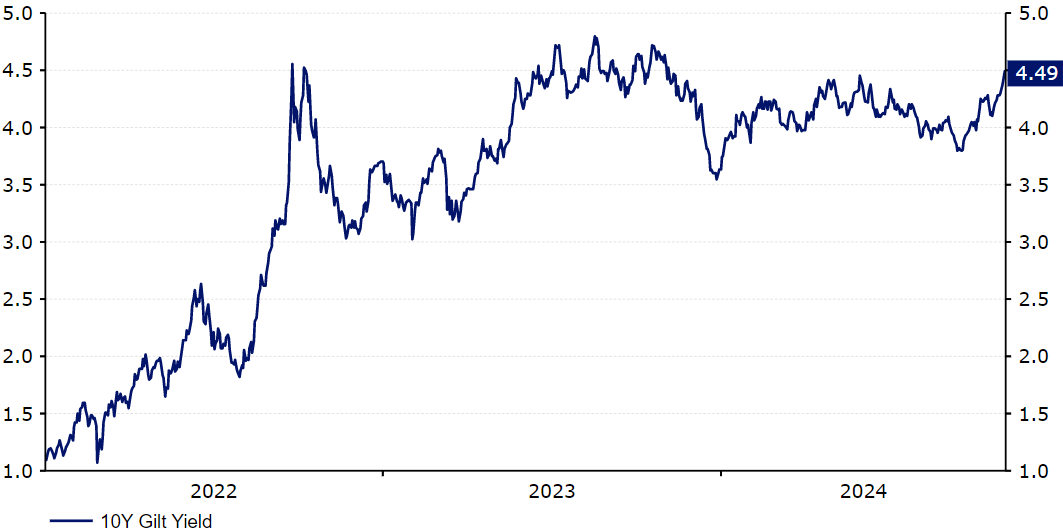

A looser-than-expected UK budget announcement prompted a sharp sell off in the gilt market last week. The general market reaction has been one of scepticism, with investors seemingly taking the view that the net impact on growth would be negative, and we strongly agree. Not only do the sharp tax hikes risk eating into business investment and household disposable incomes, but markets have reacted to the prospect of large bond issuance by sending yields upwards, which is likely to translate into higher mortgage rates. So far the damage is nowhere near the debacle that ended Liz Truss’ premiership, although the 10-year yield is now trading back around the post mini-budget levels.

The pound also suffered, and though it recovered towards the end of the week, it still lost some ground against its European peers. This unwelcome market reaction should be a key topic for discussion at Thursday’s Bank of England meeting, and the MPC’s views on its impact on policy will be the biggest driver for sterling – other than the US election.

Figure 3: UK 10-year Gilt Yield (2022 – 2024)

Source: LSEG Datastream Date: 04/11/2024

RON

Contrary to its regional peers, the Romanian leu continues to exhibit almost no volatility, keeping stable versus the euro. Domestic news has been scarce of late, with only tier 2 data out last week. On a positive note, manufacturing PMI rose from 47.3 to 48.1 in October, but of course, the data did not rock the boat.

This week will be more interesting, with the NBR decision coming up on Friday. Consensus sees no change in rates, and we agree with keeping persistent price pressures in mind. Nevertheless, signalling (including forecasts) from the central bank would still be worth watching. Aside from that, retail sales data for September will be out on Thursday, which will give us a better sense of what to expect from next week’s Q3 GDP data.

PLN

Newsflow in recent days has been a bit more favourable for the zloty than previously but the currency still extended losses last week. The currency managed to recover some losses today as Trump odds fell but we find it difficult to see it posting any sustained appreciation before the outcome of the US election is known – and not unfavourable (i.e. Trump does not win). As for the aforementioned newsflow, the fact that Eurozone growth turned noticeably better than forecasted in Q3 is particularly noteworthy.

Now attention should be primarily focused on US election which will be the main force driving financial markets in the coming days. If Harris wins, zloty should recover some of the lost ground but we have little doubt that a Trump win would further pressure the currency. Of course, in this context, a composition of Congress would matter as divided or unfriendly Congress would be seen as a major blocking factor that would limit the extent of changes to status quo.

As for local news, this week’s NBP meeting will get some attention due to the release of updated macroeconomic projections which are out three times a year. Inflation largely evolves as expected but the overall landscape is changing fast and not entirely clear. It seems that elevated inflation (now back at 5%) won’t allow for cuts in the near future but a return to policy easing next year, perhaps in March, is still highly likely.

HUF

While attention remains on the US election, which continues to affect the sentiment to the region, forint was also pressured down by domestic news last week. Q3 GDP data surprised significantly to the downside, showing a contraction of 0.7%, which means that the country entered a technical recession. We will have to wait a few weeks for details, but what we know so far indicates 2024 should not be expected to bring anything more than a very mild annual expansion, with Hungary’s growth outlook now mired in uncertainty.

Figure 4: Hungary GDP Growth [QoQ] (2021 – 2024)

Source: Bloomberg Date: 04/11/2024

Some hard data for September will be released later this week, which may help to understand the situation better. Most of the attention this week should, however, be focused on the US election with forint, next to zloty, being the currency which is likely to experience the biggest swings in the region on the results.