CEE currencies receive a small boost from the Fed

- întoarce-te

- Latest

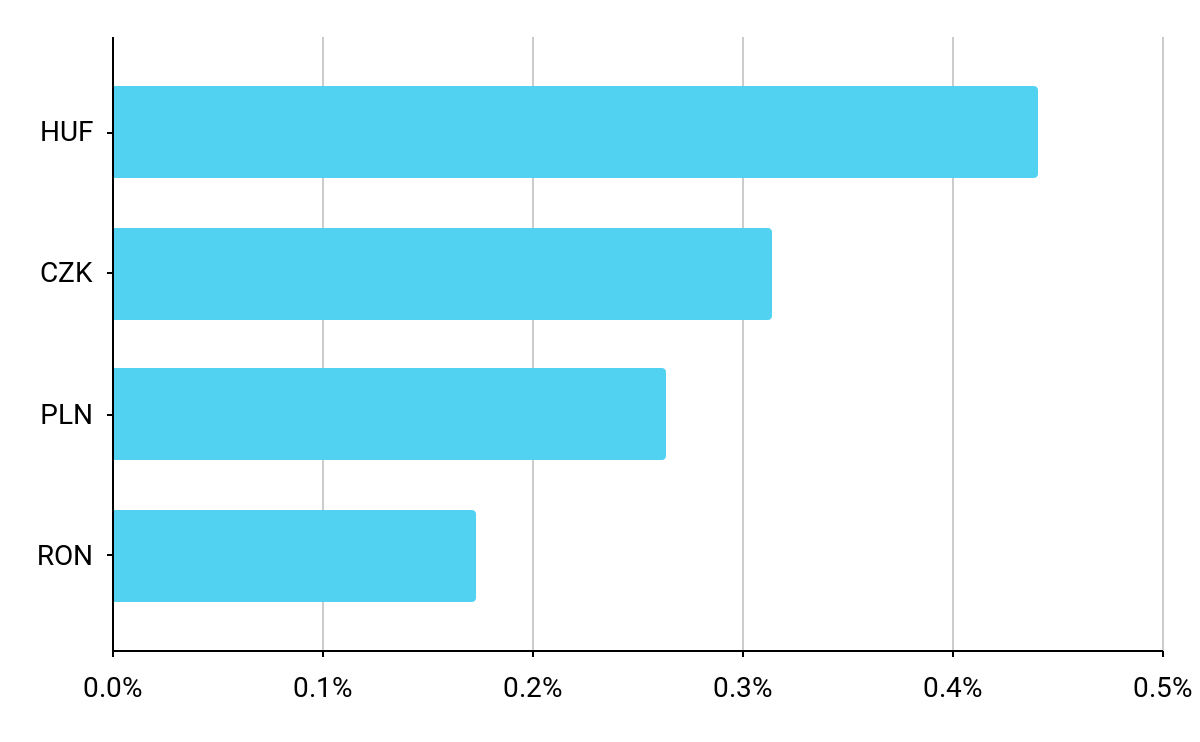

CEE currencies had a good week, rising against both the US dollar and the euro. Gains made against the latter were, however, limited with the currencies generally continuing their range-bound trading.

Figure 1: CEE FX Performance Tracker [base: EUR] (13/09 – 20/09)

Source: Bloomberg Date: 23/09/2024

USD

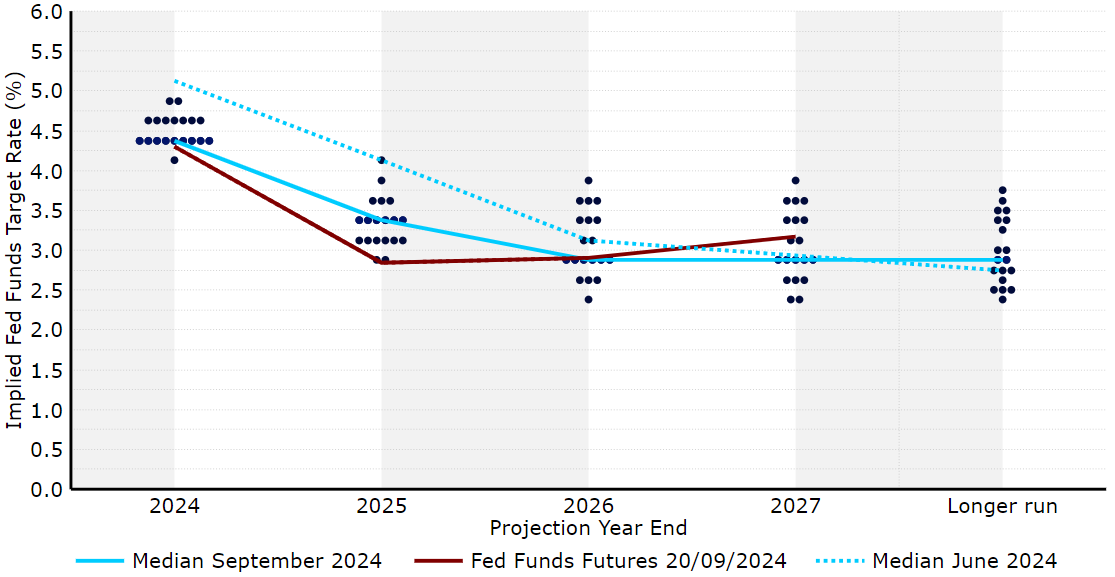

The impact on the dollar of the Federal Reserve’s 50 basis point cut was muted by a less dovish messaging from the Fed´s communication, particularly the ‘dot plot’. The Fed expects to lower rates at a relatively gradual pace. Officials now see just two more 25 basis point rate cuts this year, with four additional ones seen in 2025. Indeed, its estimate of the neutral level of rates in the US is still much higher than what markets are pricing in.

Figure 2: FOMC Dot Plot [September 2024]

Source: LSEG Datastream Date: 23/09/2024

Economic data continues to track at or slightly better than expectations, consistent with solid growth in the 2-3% range, and high frequency labour market indicators like jobless claims show no upward trend in layoffs. We expect the PCE inflation data to confirm the modest rebound in inflationary pressures seen in the earlier CPI report, and think the US dollar may stabilise near current levels after a rough summer.

EUR

The question of whether the ECB will follow up its September rate cut with another one in October remains unclear. We think that inflation stickiness means that a single cut per quarter is likely from now on. As the Draghi report on European competitiveness suggests, Eurozone stagnation does not seem to be related to interest rates, which would perhaps suggest no rush to cut.

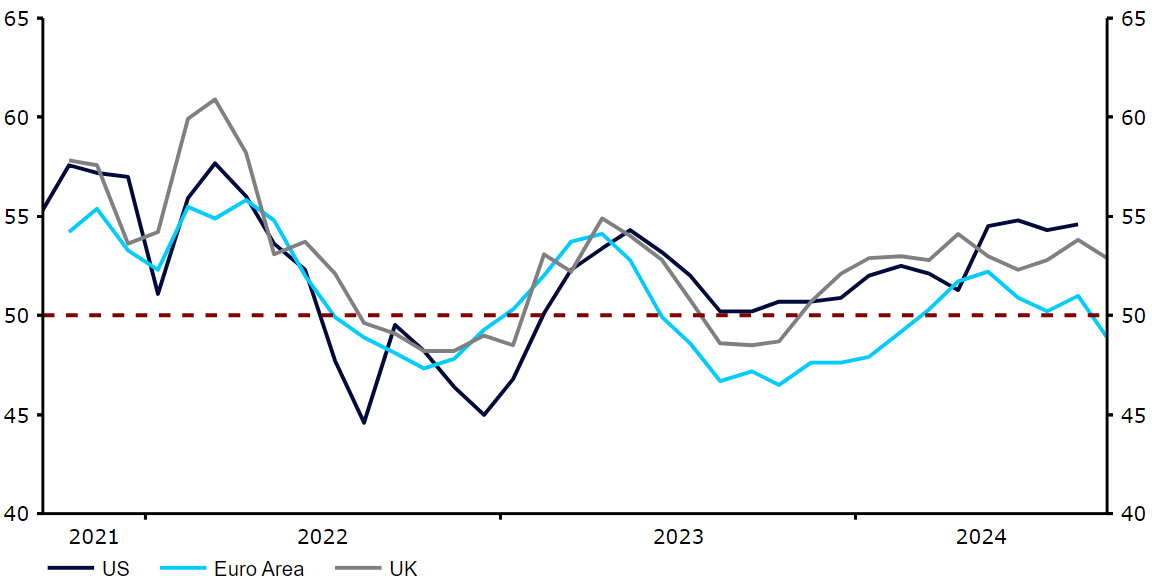

This morning’s business activity PMI figures were a disappointment, however, with the composite index slumping to January lows and printing below the level of 50 denoting contraction. This has undoubtedly made an October cut more likely, and we wouldn’t be overly surprised to see this reflected in a more dovish tone of communications from ECB officials in the coming days.

GBP

The Bank of England held interest rates last week at what is now the highest level of all G10 countries, save for New Zealand. The vote was nearly unanimous, with just one member, Swati Dhingra, voting in favour of another cut. As we had anticipated, the rhetoric in the bank’s communications were reasonably hawkish, with the bank reiterating the risks to cutting rates too quickly and by too much. The MPC suggested, in particular, that it is paying close attention to still elevated services inflation, which continues to print comfortably above 5%.

Figure 3: G3 Composite PMIs (2021 – 2024)

Source: LSEG Datastream Date: 23/09/2024

We think that the pound will remain well supported by relatively high rates, attractive valuation and decent economic growth. As mentioned, this morning’s PMI figures missed estimates, but the composite index remains above the level of 50 and continues to easily outperform the equivalent data in the Euro Area.

RON

A quieter period with regard to the macroeconomic publications from Romania is upon us. Last week did bring industrial sales, however, which once again swung upwards, reaching 10.5% year-over-year. Although the lower base and high data volatility need to be taken into consideration, the manufacturing sector seems to be doing better than the European average (which was also confirmed today by weak PMI data from the Euro Area). That said, there is a partial imbalance between production and sales, which we associate primarily with the weakening of demand in Romania’s main export destinations.

The coming days will not bring tier-1 readings from the country.

PLN

The Polish zloty had a good week, rallying sharply against the weaker US dollar like most of its peers. It only made marginal gains against its reference point, the euro, however. The situation of the Polish currency did not change significantly over the past six months or so, with the sideways trend staying strong.

Recent economic news from Poland has been quite dire, with industrial production surprising to the downside last week and construction and retail sales at the start of this one. The latter adds to the feeling that consumer rebound is not yet on a solid footing. Labour market data came mixed, with a sharp decline in employment coinciding with increased wage growth. A continuation of the first of these trends for some time seems more likely. Moreover, recent outside signals, notably from the Eurozone, add to concerns about Poland’s exports. It’s not exactly what we would want to see. After today’s data, there’s not much on tap in terms of domestic data releases this week, with only unemployment reading out tomorrow. Zloty will likely continue to respond to external signals. It would be interesting to see whether the increased gloom pushes EUR/PLN outside of its tight trading band, but judging by early trading from today, it is probably not on the cards.

HUF

Despite the lack of significant domestic macroeconomic readings, the forint ranked right at the top of the regional currencies’ chart last week. The move was supported by improved risk sentiment sparked by a jumbo cut from the Fed.

The coming days promise to be far more interesting internally. The MNB meeting is ahead of us (Tuesday). After a pause in August, the result of a rebound in both inflation (4.1%) and core inflation (4.7%), we expect a return to cuts. Price growth has surprised to the downside since the last meeting (headline at its lowest level in 3.5 years at 3.4%), which could be one of the key determinants of the move. Moreover, the room for easing appears to be large, as rates are at their highest level in the European Union (6.75%) and one of the highest in Europe.

Following the groundbreaking FOMC meeting, we are also keeping a close eye on changes in global sentiment, which the forint is particularly vulnerable to. Following the publication of very poor PMI data from the Euro Area, the Hungarian currency is losing ground.