CEE currencies recover

- întoarce-te

- Latest

Following a period of depreciation, induced by Middle East tensions risk-off, the CEE currencies are back on their feet. Zloty, leading the pack, was one of only 3 EM currencies worldwide to strengthen against the generally well-performing dollar.

This week is rather calm macro-wise – both externally and internally, with the ECB meeting and China stimulus signals standing in the forefront.

Figure 1: CEE FX Performance Tracker [base: EUR] (04/10 – 11/10)

Source: Bloomberg Date: 14/10/2024

USD

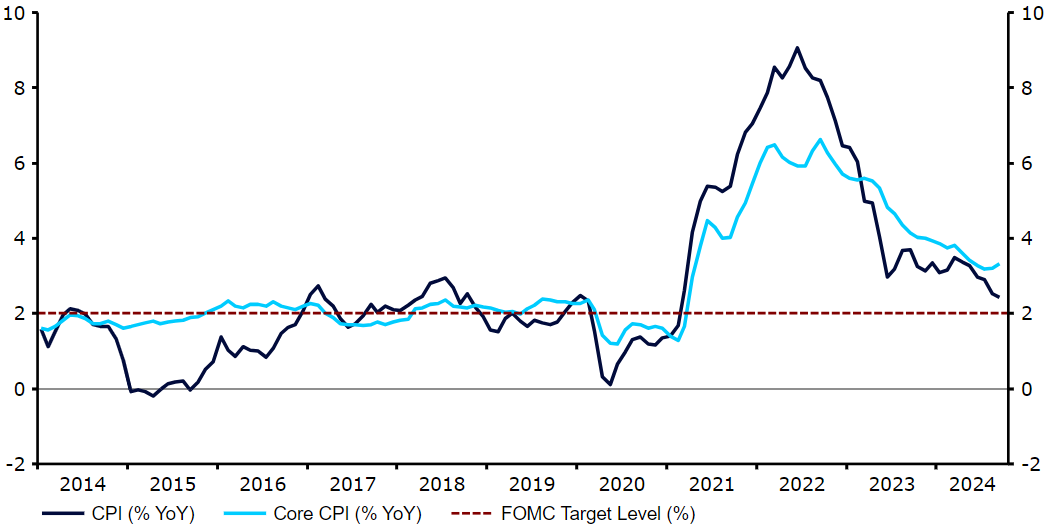

Long term interest rates, and with them the dollar, have risen steadily since they hit a low right after the Fed’s 50bp cut. Last week’s inflation numbers further fuelled this trend. Core inflation for September came in higher than expected, and our favourite inflation indicator, the three-month moving average of this index, has now risen for three consecutive months to an annualised level closer to 4% than to 3%.

Figure 2: US Inflation Rate (2014 – 2024)

Source: LSEG Datastream Date: 14/10/2024

This is not yet enough to derail the Fed’s commitment to a cut rates at each of its remaining meetings in 2024, but with the US economy growing at 3% and the labour market in full employment, it suggests that the bottom for US rates is closer than markets are currently pricing in. There isn’t a huge amount of economic news out of the US this week, although we will be looking to Thursday’s retail sales report to get the latest read on the state of consumer demand.

EUR

Dismal readings from the Eurozone economy continue to weigh on the common currency, although the recent upward revision to the September PMI data has somewhat allayed investor concerns. The announcement of aggressive stimulus in China has partly counteracted the gloom, even if markets have been left underwhelmed by the details of the measures.

The focus among markets will be on the tone of the communications at the ECB October meeting on Thursday. The central bank is normally reluctant to over communicate, particularly in meetings like this weeks, where the staff forecasts will not be updated. A lack of commitment to an aggressive calendar of interest rate cuts may finally put a floor under the common currency.

GBP

Sterling has retraced some of its blistering 2024 rally in the last two weeks, a retracement triggered initially by dovish comments by the Bank of England governor Andrew Bailey. However, we think that the bullish case for the pound remains, supported by attractive valuation, relatively high rates and a resilient economy, which is likely to ensure that the MPC’s easing cycle remains a rather gradual one.

The various labour data points and, critically, the September inflation print, will be a test for our view this week. The consensus of economists expects labour data consistent with a full employment economy and inflation numbers trending down, but still considerably above Bank of England targets, both of which should be supportive of the pound. Investors will also have one eye on this month’s budget announcement from the new Labour government, which is expected to see the unveiling of a number of revenue raising tax hikes.

RON

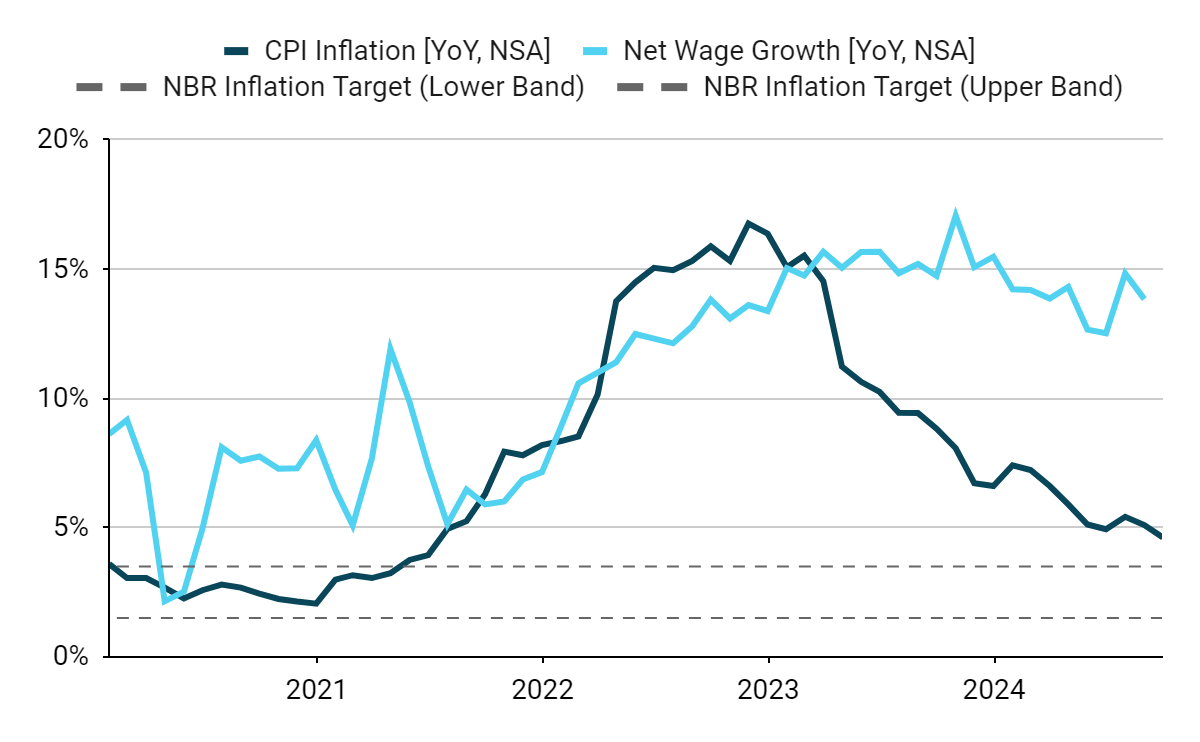

Inflation in September showed another decline, which brought it to its lowest level in 39 months (4.6%). Momentum, however, remains high (3MAA at 5.5%) and the adjusted CORE2 measure increased in August (5.7%), which should prompt the NBR to be rather cautious, particularly in view of the lacklustre fiscal situation. Wage growth has slowed, but is still very strong (13.8%), posing a non-negligible pro-inflationary risk.

Figure 3: Romania CPI Inflation & Net Wage Growth [YoY, NSA] (2020-2024)

Source: Bloomberg Date: 07/10/2024

The coming days will focus on manufacturing. Industrial output remained weak with today’s reading showing a -2% YoY. We are now awaiting industrial sales data due on Friday.

PLN

In the EM FX, the earlier losers turned winners last week, and the PLN was one of them. After reaching 4.32, the EUR/PLN pair marched down and is now trading below the psychological 4.30 mark. Local newsflow has been scarce lately, with the focus primarily on the outside signals.

This week will bring more of the same – Tuesday’s second inflation reading is unlikely to rock the boat, neither is Wednesday’s core inflation print. Price pressures in the Polish economy are still too high for the decisionmakers to entertain cuts in the near future. The topic should return towards the end of the year as we approach the March meeting, which has been signalled by President Glapinski as one where we may see a cut.

HUF

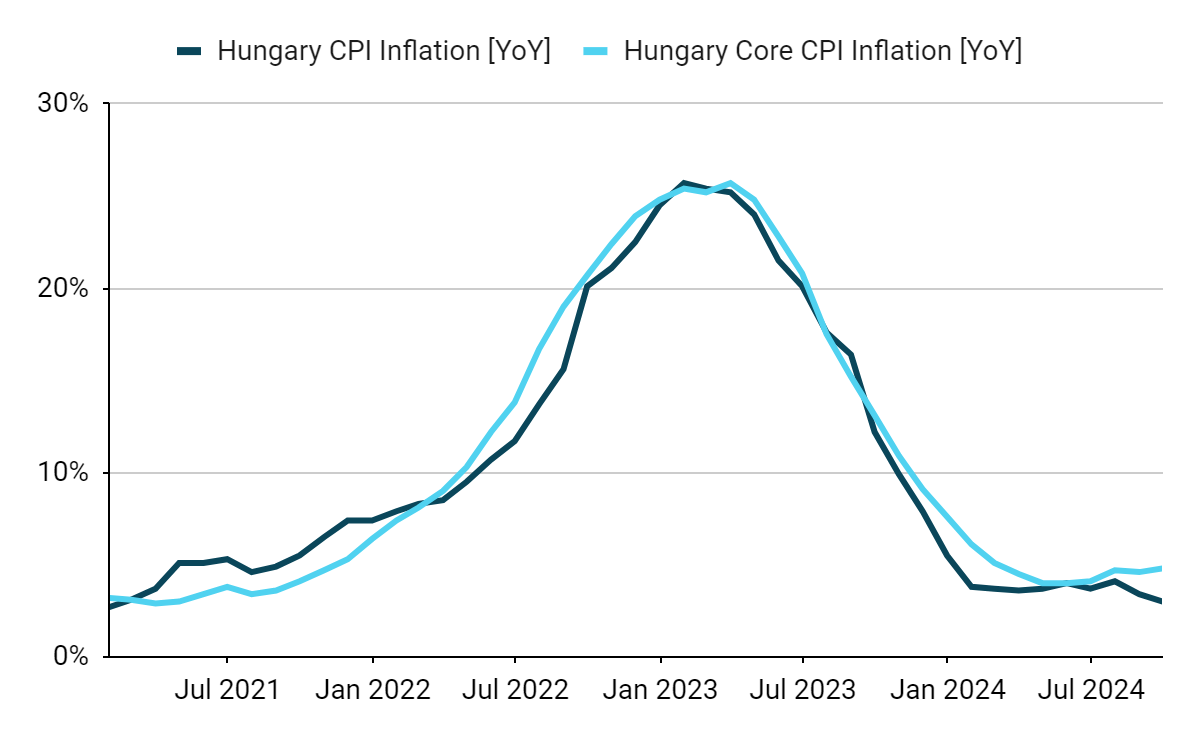

Our expectations of a more dovish MNB are finding backing in the macroeconomic data. Inflation recorded a decline in the past week, a larger-than-expected one (to 3%), showing a month-over-month contraction. This served as one of the key factors holding back the appreciation of the forint against the benchmark euro, with the currency finding itself at the bottom of the CEE scoreboard. The core measure increased ever so slightly, however (4.8%), which did not go unnoticed and makes us believe that a jumbo cut will not be a base case scenario for the upcoming meeting scheduled for 22 October.

Figure 4: Hungary CPI & Core CPI Inflation [YoY] (2021 – 2024)

Source: Bloomberg Date: 14/10/2024

Prior to the decision, we will only receive second-tier readings, thus the volatility on the forint will be mainly determined by external factors.