The ‘Trump trade’ continues to drive markets worldwide, and currencies are no exception.

This week is unusually heavy in terms of macroeconomic releases. In the Eurozone, third-quarter GDP (Wednesday) and the key October flash inflation report (Thursday) will drive pricing for upcoming ECB rate decisions. In the US, we’ll get third-quarter GDP figures (Wednesday) and the all-important US payrolls report for October (Friday). We expect this deluge of data to take a back seat, however, to the batch of polls to be released in the final stretch of US election campaigning.

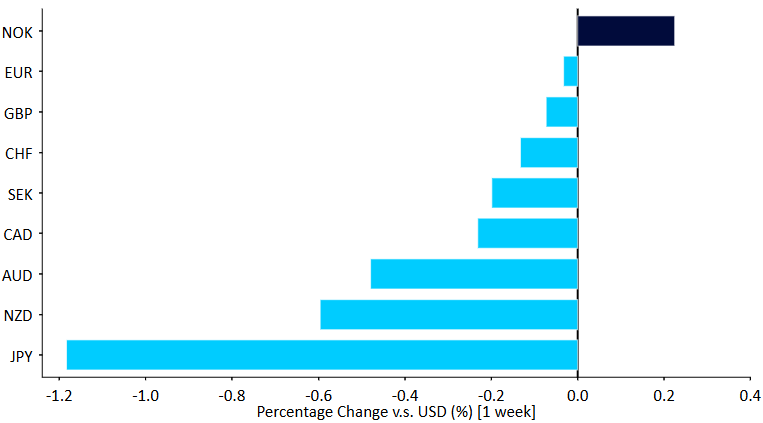

Figure 1: G10 FX Performance Tracker [vs. USD] (1 week)

Source: LSEG Datastream Date: 28/10/2024

USD

Economic reports out of the US continue to surprise to the upside, although this dynamic is mostly overshadowed by the headlines and polls about the presidential election, which will take place next Tuesday (05/11). Trump now holds a relatively healthy advantage according to the latest odds and predictions models, and is ahead in the opinion surveys in five of seven swing stages. We advise against taking late release polls too seriously, however, and we far from see the election as set in stone, particularly given how inaccurate the polls have been in the recent past.

Figure 2: US Election Odds [Polymarket] (Aug ‘ 24 – Oct ‘24)

Source: LSEG Datastream Date: 21/10/2024

Friday’s nonfarm payrolls report continues one of the two most important data points worldwide, the other being US inflation. The Federal Reserve will be paying very close attention to the wage growth number, given the rebound inflation data we have seen recently. The Fed’s preferred measure of inflation, the PCE index, will also be released on Thursday.

EUR

Last week saw no break in the streak of dismal economic data out of the Eurozone. The best that can be said for the PMIs of business activity for October is that they got no worse from September, although they didn’t improve either. At best, recent macroeconomic news has been consistent with a stalling Eurozone economy and, at worst, a an outright quarterly contraction in GDP. High employment, and the absence of signs of significant jobs destruction, may be just enough to keep the Eurozone out of a technical recession, however.

This week’s GDP numbers are important, although they are lagging indicators that provide no clear read as to the current state of demand. More timely will be the October flash inflation report, which will be a key input to the next ECB rate cut decision. Communications from ECB president Lagarde have been dovish in recent days, and markets are now fully pricing in four 25bp cuts in each of the next four Governing Council meetings.

GBP

The pound remains the best performing G10 currency, and second only to the South African rand, among the majors so far in 2024. The PMIs of business activity, out last week, confirmed that Britain’s economy continues to grow, in contrast to European stagnation, albeit at a slightly weaker pace than expected. Yet, with UK inflation now back below the Bank of England’s 2% target, market participants are increasingly pricing in a more aggressive MPC easing cycle.

This week’s budget statement from the Labour government is shaping up to be an unusually sizable political event risk for sterling. Sweeping tax hikes are expected, with capital gains tax, employer NI contributions, inheritance tax and pensions all likely to be targeted. Chancellor Reeves will also provide details on Labour’s fiscal rule change, which is expected to unlock billions of pounds in extra borrowing. Should she successfully convince investors that Labour have a credible plan to boost growth, without triggering a blow up in the gilt market, then the pound could emerge unscathed, but this remains a big if.

Figure 3: UK PMIs (2021 – 2024)

Source: LSEG Datastream Date: 28/10/2024

RON

The Romanian leu maintained its typical resilience last week. While other CEE currencies suffered losses, the leu was effectively unchanged against the euro.

The economic calendar was empty last week, while this one will see the release of a handful of readings, including the unemployment rate (Thursday) and manufacturing PMI (Friday). The former will provide some context on the current state of affairs, and the latter will also give a bit of a glimpse into the future.

PLN

The zloty took hits from multiple sides last week and ended the week as one of the worst-performing emerging market currencies, shedding almost 1% against the euro. The currency became particularly vulnerable in the face of the ‘Trump trade’, but divergence in economic performance between the US and Eurozone has also taken its toll on EUR/USD and zloty, which closely follows the pair. However, local news has also been dire lately, not helping the currency.

Nearly all of the key readings surprised to the downside last week, with retail sales particularly weak. A surprise contraction (3% YoY in real terms), the first this year, likely overestimates the extent of consumer demand weakness but is nevertheless a negative sign. If the data continues to disappoint, the timetable for NBP cuts might be brought forward. The zloty will likely continue to react largely to outside news in the coming days. Thursday’s preliminary inflation data covering October has little potential to cause significant swings in the currency but will, nevertheless, be worth watching.

Figure 4: Poland Real Retail Sales [YoY] (2019 – 2024)

Source: Bloomberg Date: 28/10/2024

HUF

The Hungarian forint sold-off by over 1% against the euro, underperforming all of its regional peers. The extent of the sell-off can be attributed to the currency’s high-beta status, which makes it particularly susceptible to swings in market sentiment. Locally, the news was actually favourable for the forint as the National Bank of Hungary left rates unchanged and sounded a relatively hawkish note. The message was that of caution, and Deputy Governor Kandracs stated that rates may remain at current levels for an ‘extended period’.

Figure 5: Hungary Interest Rates (2021 – 2024)

Source: Bloomberg Date: 28/10/2024

Looking ahead, forint is likely to continue being driven primarily by shifts in market sentiment. Nevertheless, local news would also be worth watching this week, particularly the preliminary Q3 GDP data out Wednesday. It is set to show the mildest of quarterly expansions after a 0.2% growth in Q2.