Dollar rallies on as inflation fears in the US take hold

- întoarce-te

- Latest

There were divergences in the so-called Trump trade last week.

This week will be a busy one for the euro and sterling, as the flash PMIs of business activity for November will be released globally on Friday. In addition, October UK inflation will be released on Wednesday. The calendar is lighter in the US, and the focus will be on the bond market reaction to last week’s hawkish Federal Reserve speeches. In the background, markets will look for clarification on the size and extent of the coming US tariffs, as well as announcements regarding Chinese stimulus measures to counteract their effect.

Figure 1: G10 FX Performance Tracker [vs. USD] (1 week)

Source: LSEG Datastream Date: 18/11/2024

USD

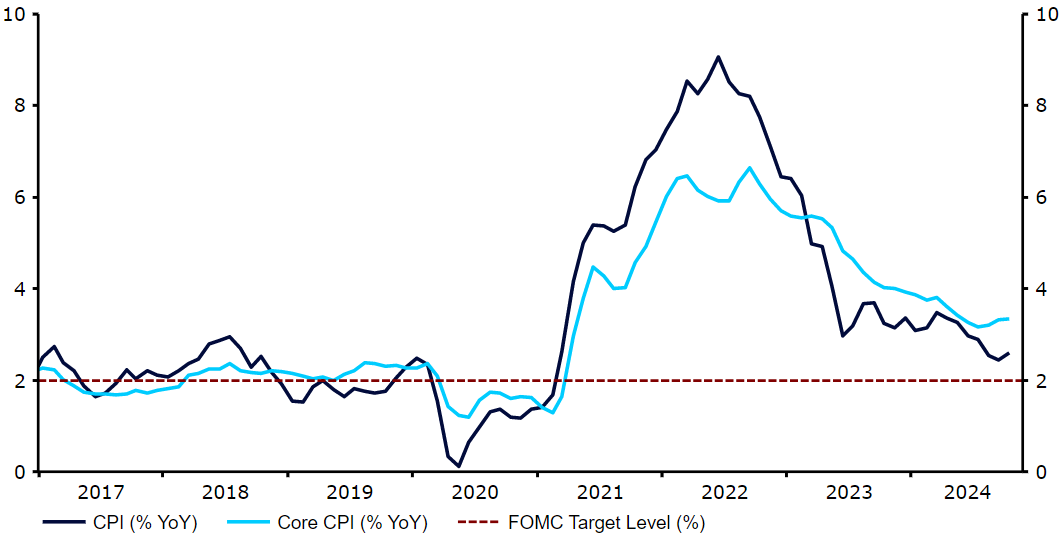

A key speech by Federal Reserve chair Powell last week made it clear that a rate cut in December is not at all a foregone conclusion, and suggested that the extent and duration of the current cutting cycle need to be revised. Markets promptly did so, though the move higher in rates had already started after yet another inflation print that showed the core index growing at a 3-4% annualized rate for the third consecutive month.

Figure 2: US Inflation Rate (2017 – 2024)

Source: LSEG Datastream Date: 18/11/2024

Markets are now pricing in a 60% chance of a December cut from the Fed. This outcome could depend completely on the single CPI inflation report that will be released before the 18th December meeting date. At any rate, it is difficult to see the Fed bringing the rate significantly below 4% under the circumstances, given the expected inflationary impact of Trump’s tariffs and tax cuts.

EUR

The euro continues to fall victim to the Trump trade, as US rates rise relentlessly, widening the gap with the Eurozone. The divergence between the projected paths of interest rates on each side of the Atlantic is getting starker. Markets are starting to doubt whether the Fed will cut rates at all in December, while pricing a meaningful chance of a 50 basis point cut out of the ECB at one of the next two meetings.

The common currency appears to have found some sort of a floor around the 1.05 level. The sell off against the dollar has been pretty brutal, and current levels seem to already price in a lot of divergence in economic performance in favour of the US. A PMI number above 50, indicating that the Eurozone economy is still growing, however slowly, could puncture this narrative and offer at least some temporary support for the euro.

GBP

Sterling had a difficult week, falling to the lowest level in four months. The general downward trend in European currencies was exacerbated in the pound’s case by a weak third-quarter GDP report, which showed that the UK economy grew about half as much as expected and is hovering again near a stall level. Indeed, the economy actually contracted in September on a month-on-month basis, with the report suggesting that concerns leading up to the Labour Autumn Budget, which delivered a sizable hike to employer National Insurance contributions, weighed on business activity.

Figure 3: UK GDP Growth Rate (2022 – 2024)

Source: LSEG Datastream Date: 18/11/2024

We think the market may have overreacted to the GDP news, which is a very lagging indicator, and that the economy is doing reasonably well. Further, goods exports to the US are relatively limited and US tariffs should be less of an issue than for the Eurozone. At any rate, the PMI numbers out Friday take on added importance after the disappointing growth news last week.

RON

It was not a particularly benign week for Romania from a macroeconomic perspective. Unlike neighbouring Hungary, it could not boast any progress on the inflation front in October. The headline measure posted an uptick for the first time since June, rising at the fastest pace since February on a monthly basis (0.62%). Wage growth, one of the key pro-inflationary factors, remained consistently high and close to double digits in real terms. As if that was not enough, Q3 GDP growth surprised downwards, registering flat quarter-on-quarter growth and a rather modest 1.1% YoY.

Figure 4: Romania GDP [QoQ, SA] (2021 – 2024)

Source: Bloomberg, 18/11/2024

We will have to wait until December for the next release of tier-1 macroeconomic data.

PLN

After a return to the ‘Trump trade’ and a sell-off at the start of the week, the Polish zloty returned to the recovery mode against its reference euro despite a downtrend in EUR/USD. To some extent, we are impressed by this resilience, but the red lights are flashing. The zloty tends to recover well after shocks, but the nature of the Trump one is such that it is difficult to expect a steady calming of the situation – the environment changed significantly, and we should probably tone down our optimism regarding the zloty. The recent divergence in interest rate prospects between the US and Poland is yet another reason for this.

Domestic news has also not been too favourable of late. Preliminary GDP data confirmed that the economy softened in Q3, actually registering a contraction in quarterly terms while Q2 growth was revised down. Prospects of rate cuts in Poland are taking shape and there is an increasing argument to be made for returning to cuts in the first quarter of next year. This week sets up to be light in terms of domestic data, with more important readings to come out next week. Therefore, the attention should be primarily on external signals.

HUF

While the October inflation reading was surely cheered by decisionmakers, it is hard to expect rate decreases to return as soon as this Tuesday. The headline measure surprised and fell just above the MNB’s target of 3%, with very favourable momentum (0.0, -0.1% and 0.1% MoM, respectively) in recent months. The volatility of the currency, which has weakened by nearly 4% against the benchmark euro and nearly 10% against the dollar over the past two months, is a concern for the bank. To an extent, the impact of such a substantial weakening can be compared to the impact of monetary policy easing.

Figure 5: Hungary CPI & Core CPI Inflation [YoY] (2021 – 2024)

Source: Bloomberg, 18/11/2024

A cut may be considered at the following meeting, on 17 December, much will depend, however, on incoming data and the behaviour of the forint. The next major reading – on wage growth in September – is due on Friday.