Dollar romp continues as US labour report smashes expectations

- întoarce-te

- Latest

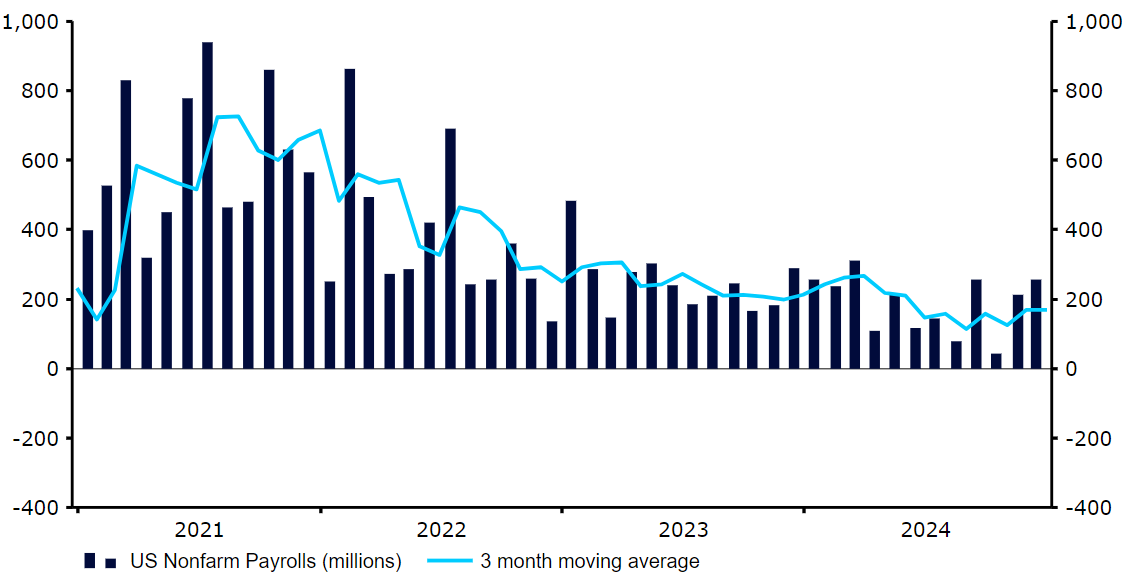

The relentless dollar rally continued for yet another week, fuelled by sharply higher bond yields in the US and signs that the world’s largest economy is, yet again, gaining momentum.

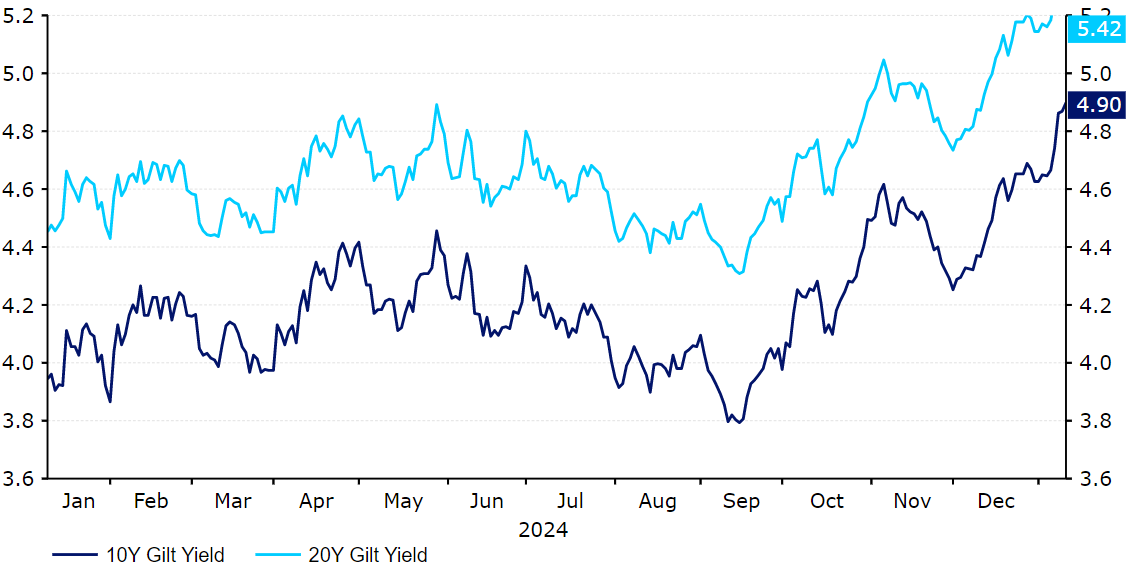

The inflation numbers out of the US and the UK (Wednesday) will be key events for markets. Their respective sovereign bond markets are looking apprehensively at the flood of new bonds these governments need to issue, and core inflation in both countries remains above 3%, which is not helping. For now, higher rates are supporting the dollar, while having the opposite impact on GBP. This week will be a quiet one in the Eurozone, so the common currency should trade mostly off events elsewhere.

USD

The prospect of any Fed rate cuts at all in 2025 are fading fast, and the all important 10-year Treasury rate has risen by a massive 120bps since the first cut in September – an unusual response to Fed easing, to say the least. Emerging market currencies are selling off, too, although the week’s loser was clearly the pound, whose fall was accelerated by a worrisome sell-off in gilt markets. A shout out to the Brazilian real, which managed to end the week up against almost every other major currency – a sign that the brutal sell-off in the currency in late-2024 may have finally rendered it a compelling value.

The inflation numbers out of the US and the UK (Wednesday) will be key events for markets. Their respective sovereign bond markets are looking apprehensively at the flood of new bonds these governments need to issue, and core inflation in both countries remains above 3%, which is not helping. For now, higher rates are supporting the dollar, while having the opposite impact on GBP. This week will be a quiet one in the Eurozone, so the common currency should trade mostly off events elsewhere.

Figure 1: US Nonfarm Payrolls (2021 – 2024)

Source: LSEG Datastream Date: 13/01/2025

EUR

The euro had another difficult week against the dollar, driven down by higher Treasury yields and yet another strong payrolls report in the US. We will point out, however, that the rate increase in the Eurozone bond markets almost matched the move in the US, and that the yield gap has actually been narrowing for some weeks, which should be supportive of the common currency. Indeed, macroeconomic news out of the bloc last week was mildly upbeat, notably the latest unemployment data and revised PMI figures, which provides reason for very cautious optimism towards the Euro Area economy.

Core inflation in the Eurozone remains stuck at an annual rate of 2.7%, however, where it has been for the last four months, and ECB members will be closely monitoring the recent uptick in the main measure of inflation, which is back at its highest level since July. With the yield headwinds abating, and the currency at an undeniably cheap level, we think even marginally positive news out of the Eurozone would help stabilise the common currency.

GBP

While the violence of the moves in the gilt market did not match what we saw in 2022 after the Liz Truss mini-budget, a 25bp sell-off in merely a week where no major economic or policy news was released is still a remarkable downdraft. The pound reacted poorly to the turmoil, falling against all of its European peers by 1% or more. This appears to be a delayed negative reaction to the details of the Autumn Budget, as investors fret over the impact of the government’s fiscal measures on the state of public finances and the economy.

We think that the backdrop for sterling is significantly better than it was after the Truss budget disaster: higher Bank of England rates are supportive, and there are credible prospects for a better relationship with the EU on trade, which investors clearly view as bullish for GBP. However, it appears increasingly necessary for Labour to deliver spending cuts in order to fully stabilise the UK sovereign bond market, which remains vulnerable to any negative surprises in inflation.

Figure 2: UK 10Y Gilt Yield (2024 – 2025)

Source: LSEG Datastream Date: 13/01/2025

RON

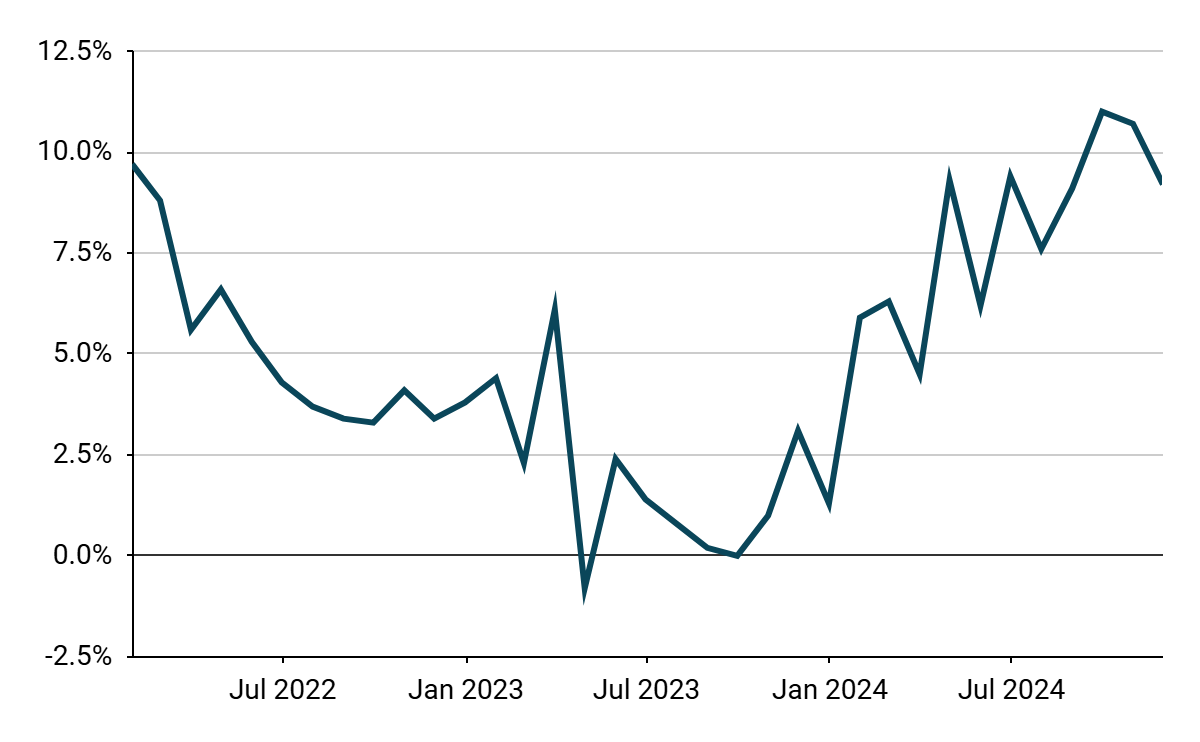

Last week’s macroeconomic data has painted a rather healthy picture of the Romanian economy. We have seen real retail sales print at 9.2% YoY, with Q3 GDP revised upwards to 1.2% YoY (and no longer pointing to a QoQ contraction). Unemployment, meanwhile, edged down once again, placing at 5.3%, lowest since June.

Figure 3: Romania Real Retail Sales (2022 – 2024)

Source: Bloomberg, 13/01/2025

We are now awaiting Tuesday’s inflation print, which should confirm that price pressures remain elevated. Wednesday’s NBR meeting is not set to bring much excitement, with economists firmly expecting yet another pause. Any communications regarding further moves could be considered crucial, albeit we do not foresee the forward guidance to be too concise, considering the plethora of uncertainties surrounding the outlook.

HUF

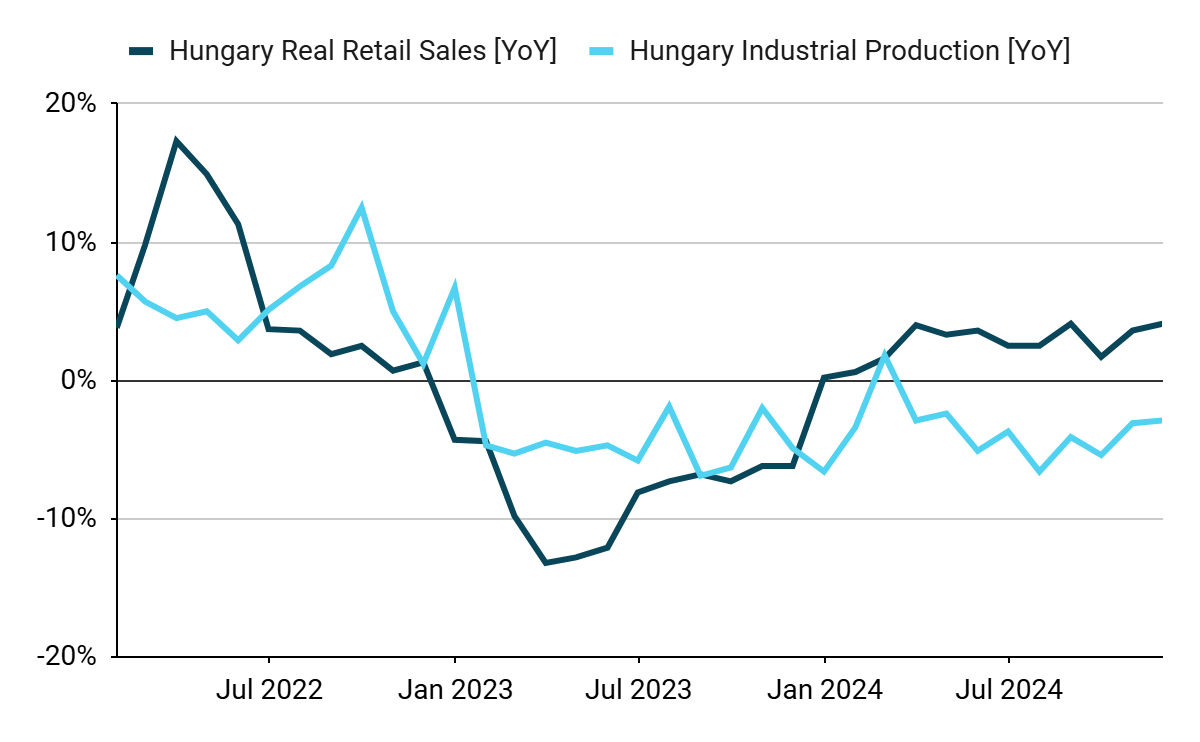

Forint’s decent performance last week can largely be considered a normalisation following a very bleak period for the Hungarian currency. Recent dollar appreciation (and a following bout of risk-off) has harmed it significantly, causing a 5% depreciation over a rather poor-performing euro in the last 4 months. Data published in recent days has been mixed, reinforcing trends observed in the Hungarian economy lately – industrial production failed expectations at -2.9% with retail sales skewing up to 4.1%, highest since August.

Figure 4: Hungary Real Retail Sales & Industrial Production (2022 – 2024)

Source: Bloomberg, 13/01/2025

The next few days will bring inflation numbers for December (out on Tuesday). Due to a lower base effect, the headline number is set to hit the highest level in a year. The scale of the move, as well as the monthly change, could be considered particularly important, as the MNB is approaching a period when rate cuts might once again be considered viable. We do not foresee a rate reduction at the upcoming meeting (28/01), another pause in February is not certain, however.

PLN

The zloty ended the week marginally stronger versus the euro but its performance was not exactly impressive – the currency actually fared worse than most of its EM peers. External news and behaviour of the main pair remain key as markets await the inauguration of Donald Trump next Monday (20/01).

Meanwhile, the attention will be partly on domestic developments, particularly the first meeting of the National Bank of Poland this year. After a rather surprising twist from Governor Glapiński in December (that suggested no cuts until 2026), markets should be particularly sensitive to signs that it was more of a theatrical overreaction rather than an actual firm signal of a change of course of the MPC. As markets, nearly all economists including ourselves expect a resumption of rate reductions this year, with discussion focusing on their timing and extent.

Aside from that, it is worth noting that the time of Poland’s presidential election has been set, with the first round scheduled for 18/05. Their market impact should be much more limited than the parliamentary ones. However, some reaction to the election would not come as a surprise, particularly if the current front-runner, Trzaskowski, saw a significant deterioration in polls. This would signal that the government-presidential spat could continue and remain a blocking factor for a number of reforms.