In a sideways trend

- întoarce-te

- Latest

Despite the improvement in risk sentiment, the region’s currencies have, for the most part, weakened marginally against the euro. Over the past month, all remain within very tight ranges against the euro.

The calendar remains largely empty within the region. The most noteworthy piece of data will come from Poland (August labour market report out on Thursday).

USD

The inflation number in the US came out higher than expected, as the core subindex increased 0.28% on the month, its second consecutive increase. Our favourite inflation indicator, the three-month core running average, has stopped falling and is perking up, though it is still close to the Fed target.

However, markets chose to ignore the number, as well as further indications that there is little job destruction in the labor market, and relentlessly increased its pricing of a jumbo move by the Fed this week to as much as 60%. We think this is excessive, expect a 25 bp cut and consequently think there is room for a tactical strengthening of the US dollar this week.

EUR

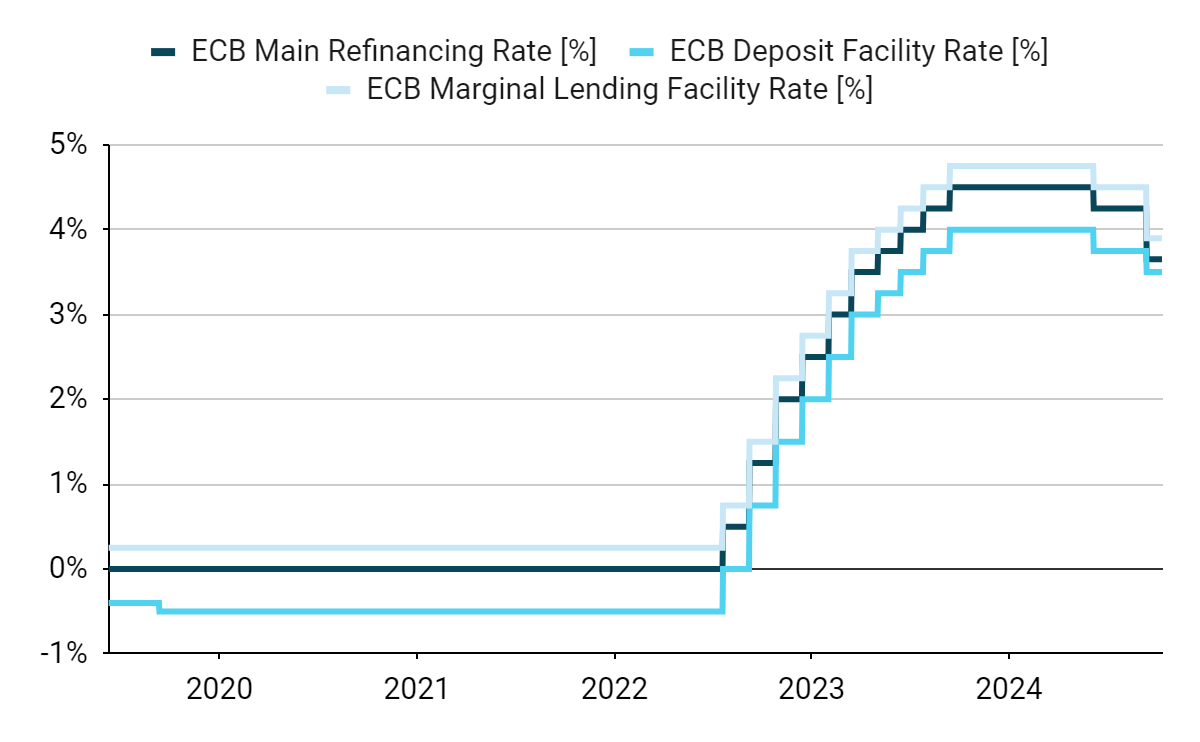

The ECB cut rates as expected last week but provided little guidance about the future path of cuts. However, it hinted that a move at the next October meeting was not likely. Rate markets moved in sympathy with US ones afterwards to price in a 1-in-3 chance of such an outcome, but we think that it is unlikely.

Figure 1: ECB Policy Rates [%] (2019 – 2024)

Source: Bloomberg Date: 15/09/2024

Dismal Eurozone industrial production numbers will weigh less on that decision than sticky inflation numbers and relatively generous recent wage agreements, as the problems of the German industrial sector are structural and have little to do with interest rates.

GBP

We expect a frantically active week in pound trading. The key August inflation release on Wednesday will be followed by the BoE rate decision the next day, too close in time for the former to meaningfully affect the latter in our view. Economists are almost certain the outcome of the meeting will be a hold, though markets are pricing in a 1-in-5 chance of what would be a surprise cut.

The expected temporary rebound in inflation and Bank of England hold at the relatively high rate of 5% should help sterling remain at the top of the rankings among major currencies so far in 2024.

RON

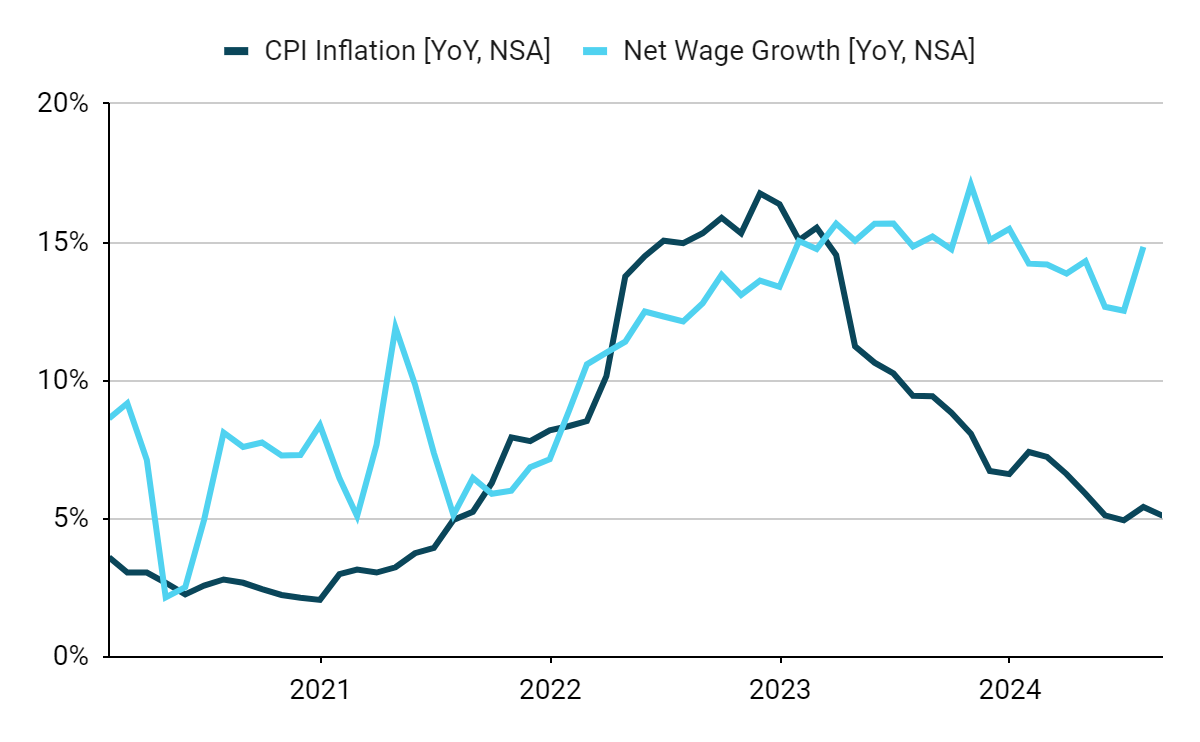

The latest news out of Romania does not fill the NBR with optimism. August inflation exceeded expectations (5.1%), while wage growth rose to its highest level this year (14.8%), which should – once consumer sentiment abates – keep price pressures elevated for longer. Industrial output disappointed again (-3.9% in July) and the current account approached its largest deficit ever at this stage of the year in the same month.

Figure 2: Romania CPI Inflation & Net Wage Growth [YoY, NSA] (2020-2024)

Source: Bloomberg Date: 16/09/2024

The macroeconomic fundamentals have remained unfavourable for months and this does not look set to change any time soon. The economic activity is moderate, yet it should be remembered that Romania has managed, unlike most other economies, to avoid a post-COVID recession. The NBR has a rather tough nut to crack, it seems to us, however, that in the face of a degree of resilience in inflation (particularly the CORE2), it will take a rather cautious approach to further easing. This week will not bring us answers to many questions in this regard as the macroeconomic calendar for Romania is largely empty.

PLN

EUR/PLN jumped to the 4.30 mark at one point, but the pair ended the week nearly unchanged, with the zloty outperforming its regional peers. Local news had little impact on the situation in the FX market, with the attention squarely on the external situation.

This week, the domestic economic calendar promises to be busier, with the August labour market data and industrial production, out Thursday, particularly noteworthy. Nevertheless, the attention will likely remain on the outside news, namely the Federal Reserve decision – in a way, it will guide central banks worldwide, including the National Bank of Poland.

HUF

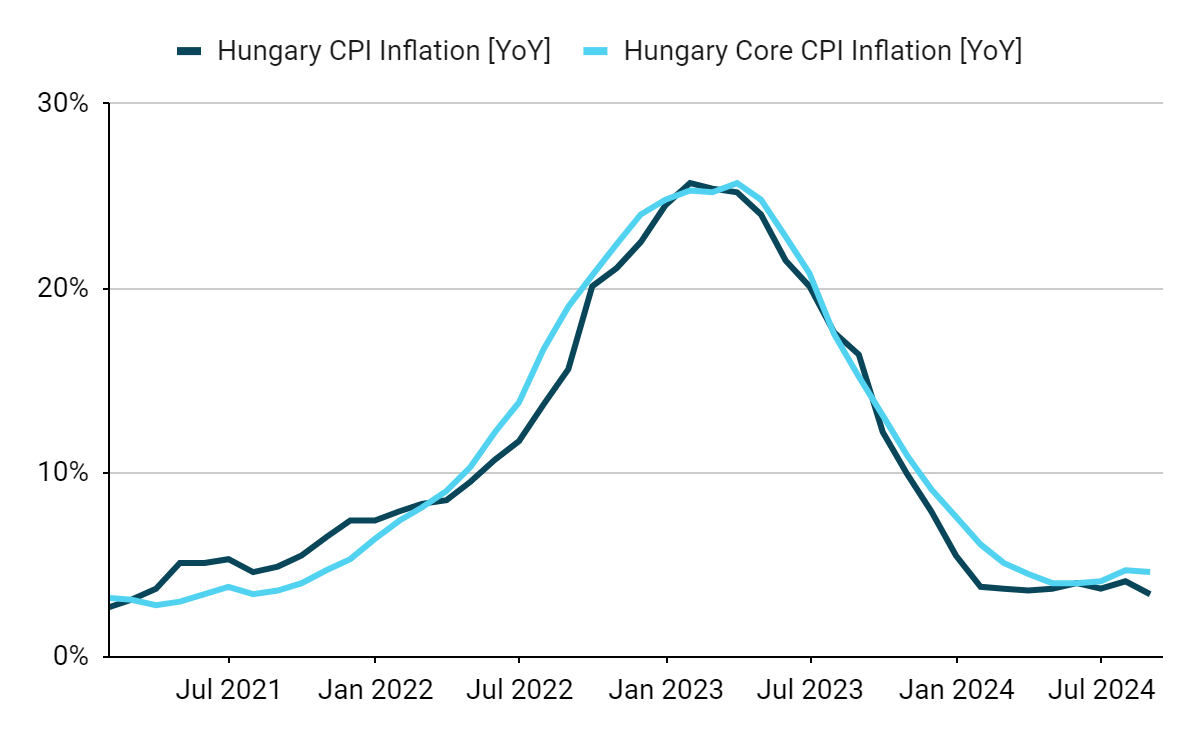

August inflation came in below expectations, reinforcing our belief that the MNB will decide to cut interest rates again in a little over a week’s time. On a monthly basis, prices remained unchanged; on an annual basis, we have not seen a number this low since February 2021 (3.4%). The core measure The forint itself, despite the positive risk sentiment, weakened slightly against the euro (by a quarter of a percent).

Figure 3: Hungary CPI & Core CPI Inflation [YoY] (2021-2024)

Source: Bloomberg Date: 16/09/2024

The calendar for the coming days is largely empty. The Hungarian currency will depend, like other risk currencies, on the change in sentiment which may be triggered by Wednesday’s FOMC decision. It will take until 24 September for us to receive a decision from the MNB.